As Engineers we create products, develop solutions. These projects not only (could) have a potential benefit for the society development and wellness of the people who would use our products.

From this idea, we could endorse an utopical image of the world, where our services are offered as a gift to the world, because, Who wouldn’t love being part of the progress of this society, impacting lots of lifes over decades or, even more, over centuries?

This sounds great, but it would be way better if we are paid for this.

The cruel reality is, we all need money. We all want money. People or enterprises, everyone is looking for money, making more and more profits. In this course we have to attach to this point of view. An Engineer’s work has value, it could be represented as a factual payment, each company deserves profits for their services. This thinking is healthy, because we deserve that paid for our services. This self-valuing thinking is responsible of all our Economy, for several centuries.

Settled our basis, let’s dive in Engineer Econ.

A brief definition of Eng. Econ.

A whole definition I found about EE. Engineering economics quantifies the benefits and costs associating with engineering projects to determine if they save enough money to warrant their capital investments. Engineering economics requires the application of engineering design and analysis principles to provide goods and services that satisfy the consumer at an affordable cost.

Engineering economics involves the systematic evaluation of the economic benefits of proposed solutions to engineering problems. The engineering economics involves technical analysing with emphasis on the economic aspects and has the objective of assisting decisions.

Engineering economics is closely aligned with Conventional Micro-Economics. It is devoted to problem solving and decision making at the operational level. Thus “Engineering Economics refers to those aspects of economics and its tools of analysis most relevant to the Engineer’s decision making process”

What’s the value of money? Does it value always the same?

No.

There are multiple causes why money could value different from day to day (I recommend read the book 50 Economics Ideas: You Really Need to Know to visualize some of them). Here we are talk about just one: Inflation.

According to Investopedia, inflation is a measure of the rate of rising prices of goods and services in an economy. If inflation is occurring, leading to higher prices for basic necessities such as food, it can have a negative impact on society.

Inflation occurs when a country decides print more money, the more money are in circulation, the less intrinsic value has it.

It’s very important taking into consideration inflation in our economical decitions, due our money is deprecating everyday!

Let’s talk about simple math: Interest.

While we don’t have money, we can not make lots of things ( Just ask to a broken teenager all the stuff he would love to do, if he had some money). We can buy stuff, we can waste that money, we can save it, or we can invest it.

Banks have this idea as core in their bussines model: while you save your money with them, they can get large amounts of money. They decide invest some percentage ( most of it) of all the money, in multiple stuff ( stocks, for example, and a long list I don’t wanna talk here). Basically, you are trusting in Banks they make whatever they want with your money. In reward, they pay you some amount of money for let them make bussines with your money. That amount is called interest.

Interest, according to the book 50 Economics Ideas: You Really Need to Know is the basis of Economy.

There are multiple ways of calculating interest, each model makes in different way the payment of the interests. Every credit, savings account, mortage, National debt . . . defines which model of interest shall use.

Simple interest

Note: all definitions were taken from the book: Introductory Mathematical Analysis for Business, Economics, and the Life and Social Sciences.

You start with some amount C.

The interest each period is a fixed amount, calculated over the initial amount C.

It could be represented as:

Where:

r is the Interest rate.

C is the initial amount of money ( at t=0)

n is the number of periods to considerate.

Ps is the amount of interests generated in one period.

F is the money after t=n periods of time.

Compound interest

You start with some amount C.

The interest each period is calculated over the amount of money you already have ( initial amount plus past interest generated).

It could be represented as:

Where:

r is the Interest rate.

C is the initial amount of money ( at t=0)

n is the number of periods to considerate.

F is the money after t=n periods of time.

As a comparition. Let’s say we have 5% as interest.

If we define it as simple, after 200 periods of time we’ll have 11 times our money.

But if we define our interest as compound, our money will multiply 17300 times. Awesome!

Nominal interest rate.

Nominal interest rate, is calculated without taking consideration inflation over money. It throw us the turn over we get from our investments, savings plans, and so on.

Efective interest rate:

Most of the times, banks presents their interest rates as annual interests rates. They divide this quantity in 12 periods, and they apply this interest, monthly. Therefore, the equation of compound interest is modified in this way:

Where:

ra is the Annual interest rate.

C is the initial amount of money ( at t=0)

n is the number of periods (years) to considerate.

F is the money after t=n periods of time.

m is the number of periods (12) is applied the annual interest in a year

If we compare the original annual interest rate against the interest generated by the formula ( F/C – 1 ) we can show this is a different interest rate. This quantity is called effective interest rate.

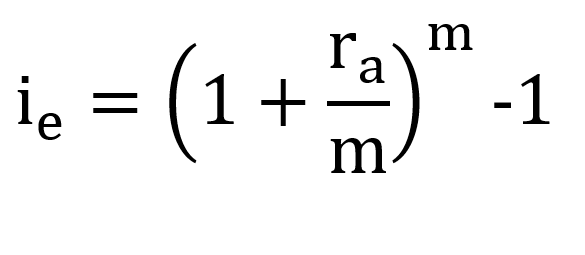

Where:

ie is the effective interest rate

ra is the Annual interest rate.

m is number of periods (12) is applied the annual interest in a year.

Conclusions

It’s so important to know (at least the basis) of Engineer Economy, in order to be capable of making decisions, analyzing if our projects are affordable enough to make them happen. Also, as engineer or employee, we need to know how exploit our money the most.

Remember, in Engineer Economy, all decisions cost money somehow.